SOURCE: RAY CHUAN rchuan@verizon.net

The Great Property Tax Heist

3 October 2005 - 1:45pm

The

Great Heist Kauai

property owners could have benefited, as far back

as 2003, from a capping of the property assessments

(valuation) back to 2001, thereby avoiding the punishing

rises imposed on property owners just because some

other people had sold their properties at the rapidly

rising market prices. This capping of the assessed

valuation (as California and most Mainland states

had voted for in the seventies and eighties) was

the core of a Draft Bill #2058 crafted by then Council

Chair Ron Kouchi in September, 2002. In the November

Elections that year Kouchi lost to Batiste in the

mayoralty race; and was out of political office.

IN

THE MEAN TIME this Council has successfully increased

its property tax revenue from around $40 million

in 2001 to $65 million in 2005. |

SOURCE: RAY CHUAN rchuan@verizon.net

More on County Government Machinations

25 September 2005 - 11:00am

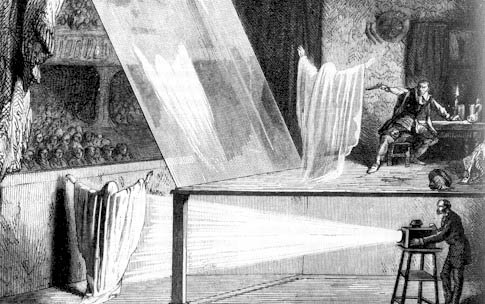

an example of "Smoke & Mirrors" from www.prairieghosts.com/smoke.html Smoke and Mirrors by Ray Chuan 24 September 2005 The Council and some of its members seem to be determined to keep muddling the water with respect to the property tax issue, piling one bill over another, and all the time assuring the public that these are temporary measures until the Task Force Plan is adopted. The whole scheme is nothing but smoke and mirrors, meant primarily to look good before the public in anticipation of an early start in the campaign to get re-elected. The most ludicrous of the host of tax bills has to be the one introduced by JoAnn Yukimura for the benefit of her friend Ito who wants to have his cake and eat it too. Walter Lewis, who also testified on her Draft Bill 2144, had the best answer to JoAnn’s question asking what Walter would propose to remedy the faults with her bill: “I would leave that to the learned Council.” Touche’ ! Hers and the other “Tax Obfuscation Bills” will come up before the Council Committees next Thursday. I sort of jumped the gun on my commentary to JoAnn’s bill by writing a letter to the Garden Island, which published it on Sept 14, a week before the bill came to the public hearing on Sept 22. Here is that Sept 14 letter: “At the September 8 meeting of the County Council a very interesting tax relief bill was introduced by Councilmember JoAnn Yukimura – Draft Bill No. 2144 – which purports to reward the owner of a single residence home (that does not qualify for any exemptions) with a 30% discount on the property tax if the owner agrees not to sell it for ten years. Nothing is said on the use of the property, which opens up some interesting features. If you look up the assessment records of most, if not all vacation rentals you’ll find that no exemptions are taken, so these properties are assessed at around $1 million and more, with a resulting property tax generally of around $4,000 and more. There appears to be no dispute that “vacation rental” is a commercial activity, yet our Council members steadfastly refuse to recognize this bit of reality. Otherwise, the property tax would be doubled. One can only surmise that our Council members believe that the use of residential property for vacation rental accrues to some public benefit and therefore deserves the lower property tax. Under Bill 2144 the owner of vacation rental property can be further rewarded with a 30% discount on the property tax – with the result that what logically would be a property tax of $8,000 would first be reduced to $4,000 by not recognizing its commercial use; and, under Bill 2144, reduced to $2,800 if the property owner promises not to sell it for ten years. After all, why would anyone want to sell when such a good deal is offered by the government? Now, let’s hear from the County Council what great public benefits accrue from vacation rentals to warrant a 65% reduction (from $8,000 to $2,800) in the property tax?” This letter elicited a response from a property owner on the North Shore who explained that she had to vacation rent her property in order to pay the ever-rising property tax, to which I wrote the following letter published in the Garden Island today (Sept 24): “In her letter in the Garden Island of September 19 Ms Larsen is perfectly correct in the way she described the plight she is caught in. The people California recognized this same problem and passed Proposition 13 in 1977 which capped the assessment of the value of real property at the value it had in 1975, with provision for inflationary rise of up to 2% per year. This is exactly what the Real Property Task Force (appointed by the Mayor and the County Council) recommended in its final plan submitted to the Council almost two years ago. That plan died under the cloud of numerous tax relief bills concocted by the Council since then, not only to confuse the public but, primarily, to allow this County Government to continue to exact an ever-increasing property tax revenue from the public – from $85 million in fiscal 2001 to $122 million in this new fiscal year – a rise of 44% in five years! In fact, there are before the Council at this moment no less than FIVE new tax “relief” bills, which are in reality “tax obfuscation bills”, including the one I commented upon (TGI Sept 14) that would give Ms Larsen at least a 30% relief, whereas the Ohana Kauai Charter Amendment and the Task Force Plan would have kept her tax at only a few percent higher than its value back in 1997 or 2000. When you own some stock its value changes from day to day and year to year; but you only pay a gain tax when you sell it and make a profit. In California and most other states the government treats real property the same way. Your property’s value (its assessment) only changes upon a sale, so if you don’t sell, your base value doesn’t change. The honest among governments, at state and lower levels, raise the property tax revenue, when they really need the rise and tell the people honestly about it, by raising the TAX RATE. This is what is meant by the term TRANSPARENCY, which is something this county will do anything, including suing the taxpayers, to avoid. Multiplying the assessment by the rate yields the tax, which, by the way, our county government never tells you. You get an assessment notice in March; and a tax bill in August which doesn’t explain the relationship between the two documents. As far as I know, we are the only government that does not tell the property owners this relationship between these two notices. The plight faced by Ms Larsen and thousands of others on this island (which, by the way, has the highest per capita tax compared to the other islands) will only come when the county would cap the assessment at some value before the sharp rise in the real estate market.” Capping the assessment is, of course, what this County government would never do! It will continue to leave the public in the dark about the relationship between the property tax and the property value assessment. The very modest proposal of the Property Tax Task Force that the tax statement that goes to the taxpayer in August and March should show this relationship, as it is done in all jurisdictions on the Mainland, was summarily ignored, of course, by the Council. After all, TRANSPARENCY is absolute anathema to the Kauai County Government. OPACITY is the governing word, which is one of the reasons Walter Lewis and I have challenged the County and are ready to take the Council to court for its “willful violations” of the Sunshine Law. This is likely to be a lengthy process that will stretch into next year, possibly beyond the next General Elections. The frequent references to this lawsuit by the media should pique the public’s interest as we head for November, 2006. It is interesting to note that members of the Council, in their campaign to polish their public image, aside from their high profile property tax relief efforts, have found another gimmick which may surprise you. In the published agenda for the Council Committee meeting of September 29, five of them – Asing, Furfaro, Kaneshiro, Rapozo and Yukimura – announce their potential conflicts of interest on Tax Bills 2142, 2144, 2145, 2146, 2147 and 2148 because they own real property in the County of Kauai. Does that mean they won’t participate in deliberations on or vote on these bills? No, not at all! Their own rules require that they publicly disclose any possible conflicts of interest with respect to any deliberations and decision making on any legislation – period! Do these disclosures prohibit them from participating in deliberating or voting on these bills? Absolutely not! So what is the point of beating their chests to show their moral-politico purity? To add more smoke and mirrors on these Madison Avenue tax bills, I guess. Very clever! But how come Council members Isero-Carvalho and Tokioka are not beating their chests? For any answer to this puzzle I suppose I should quote Walter Lewis: “I would leave that to the learned Council.” |

SOURCE: RAY CHUAN rchuan@verizon.net

More on County Government Machinations

15

September 2005 - 8:45pm

Inn Paradise Kauai vacation rentals

on the Coconut Coast

Interesting tax bill and more violations of the Sunshine Law by

Ray Chuan on September 11, 2005

While it may seem ironic that this Dump Chief Lum

campaign should be reaching a crescendo just as

the Garden Island has been running a series of articles

on the impressive record of drug busting by the

Police Dept, compared to the dismal record of the

past, before the current chief took office, an understanding

of the local political culture of deep-seated anti-non

Kauaians on the Police Force will explain a lot.

If you are not from a local family (with a Portuguese

or Japanese or Hawaiian name) and not born on Kauai

you would have a hard time being on the Police Force.

The last administration, under Kusaka, worked hard

to get rid of Chief Bob Freitas, even though he

has a Portuguese name, is from Hawaii, but had most

of his professional experience on the Mainland.

For years the Kauai Police Dept has had around fifteen

vacancies in the officers’ rank, in large

part because the department would not recruit from

the Mainland, while Oahu and the other islands do

recruit actively from “America.” Partly

because of the high vacancy rate the short-handed

force quite often has to work overtime, incurring

overtime charges, which is nothing unusual, but

in this instance has provided the Administration

and the Council with the excuse to try to get rid

of the current chief who is not from this island,

has no extended ohana here, and basically has been

raised in a cosmopolitan 20th Century culture. The Garden Island has done a credible job of responsible reporting on the performance of the current Police Department. It is up to the public to raise its voice in support of clean government and move this county out of the 19th Century into the 21st Century. Some voices at the coming Police Commission special meeting on Wednesday, Sept 14, at 2 p.m., which will no doubt be covered by the news media as well as Hoike, should help to alert the general public on the deplorable depth to which this county government has descended in playing dirty politics.

|

For

more on recent Kauai Property Tax Proposals see...

Island

Breath: Kauai Property Tax

Pau