SOURCE: JONATHAN JAY juanwilson@earthink.net

POSTED: 7 FEBRUARY 2007 - 8:00am HST

Kaua'i Spends $230,000 to Sue Itself... Huh???

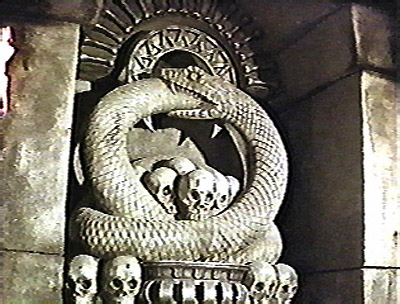

a statue of Ouroborus, the snake (worm, dragon) that devours itself tail first

by Jonathan Jay on 7 February 2007 rev 2.0 Gosh, do we live in a litigious society, or what! Our beloved County of Kaua'i is back in court today - the Supreme Court of the State of Hawai'i - defending itself against a powerful litigant with many hired guns and a huge war chest. Who is this manxesome foe? Why, it is: The County of Kaua'i! Huh?? What is going on here! Have no fear though - we shall overcome. Obviously, but the Ohana Bill does none of those things. the Ohana Bill was a classic 'Lose-Lose-Lose' a 'No-brainer' in my book, but evidently not enough folks have read my book. Unfortunately, 51.9% of the voters disagreed with me. This number I am certain is much bigger than the percentage of people on Kaua'i that will greatly benefit from the Ohana Bill, and reflexively, much smaller than the percentage of Kaua'i

residents that will suffer from a hamstrung county government that already can't fill pot-holes or empty trash cans at the beach-parks. But, when in any of the 50 states of the US of A has anyone ever voted against something called a 'tax break' (even if it was not for them, and required 85% of folks to shoot themselves in the feet)? Like Never! Tax Case Goes to Hawaii Supreme Court by Pacific Legal Foundation on 6 February 2007 in HawaiiReporter.com On February 15, 2007 from 9 a.m. to 10 a.m., the Supreme Court of Hawaii will hear oral arguments in County of Kauai ex rel. Nakazawa v. Baptiste, the appeal involving 2004's "Ohana Kauai" charter amendment. The hearing will be held in the Supreme Court courtroom in the Judiciary Building on 417 S. King St in Honolulu. The proceedings are open to the public. Details can be found at http://tinyurl.com/yneu2e In November 2004, the people of the County of Kauai overwhelmingly approved an amendment to their county Charter addressing property taxes. The Charter Amendment provided that property taxes should be restored to 1998 levels for owner-occupied homes of residents who had owned their properties since at least 1998, and for homeowners who purchased after 1998, the tax level is based on purchase price. Future tax increases for all resident homeowners could not exceed 2% per year. The Mayor and members of the County Council vehemently opposed the measure, but the people of the County thought otherwise and approved the measure by a nearly two-to-one margin. After the election, however, the County Attorney sued the Mayor, the Council, and other county officials asserting the amendment is illegal. The County Attorney claims the county council alone has the authority to determine property tax policy. The County Attorney represented both the plaintiff and the defendants in the lawsuit, and the litigation was backed with an allocation of $230,000 of taxpayer money, earmarked to hire private lawyers to attack the amendment. No one was defending the legality of the Charter Amendment, so several local homeowners were forced to intervene, asserting among other things that the lawsuit was not a true controversy since government officials were the plaintiff and the defendants, with both sides represented by the same lawyers. The homeowners argued the officials should be implementing and defending the Charter Amendment, not initiating lawsuits to strike down in court what they could not achieve in the political arena. The trial court dismissed their objections and ruled in favor of the County Attorney. Robert Thomas, the Managing Attorney of Pacific Legal Foundation's Hawaii Center represents the homeowners on appeal. There are three issues in the appeal, as noted in the briefs:When the plaintiff and the defendants in a lawsuit do not actually disagree with each other and are represented by the same lawyers, is there a genuine justiciable controversy for a court to resolve? In other words, does the court have jurisdiction to entertain a lawsuit created by government officials in order to strike down a law they politically disagree with? Article VIII, section 3 of the Hawaii Constitution says that "the counties," not the State, have the exclusive authority to determine property tax policy. The County Attorney argues that the term "the counties" means exclusively "county councils," and thus the people of Kauai had no authority to amend their Charter. The Charter Amendment is conspicuously labeled a Charter Amendment, and was proposed, passed, and certified by election officials as a charter amendment pursuant to the Kauai Charter's amendment process. The County Attorney, however, argues that the Charter Amendment was intended to be an initiative or a referendum measure (the Kauai Charter prohibits initiatives or referenda that "levy or repeal" a tax). |

see also:

Island Breath: Kauai vs Kauai 1/28/05

Island Breath: Property Tax Reform 10/24/04

Pau